Offshore Opportunity

|

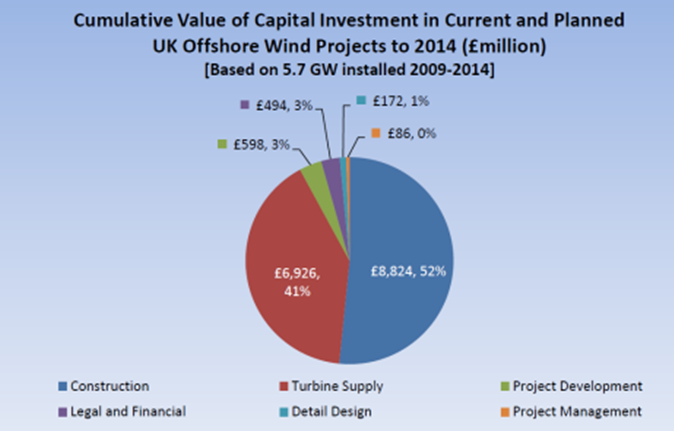

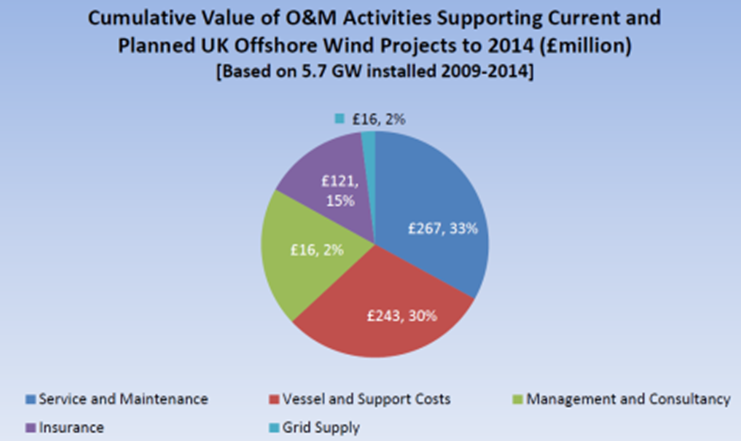

Half of the capital expenditure is spent in areas such as foundations and cabling and 30% is reserved for operations and maintenance, an area where local engineering firms have a geographical advantage. A striving supply chain will be a key driver in cost reductions which is vital in ensuring that offshore wind is an economically viable option.

Half of the capital expenditure is spent in areas such as foundations and cabling and 30% is reserved for operations and maintenance, an area where local engineering firms have a geographical advantage. A striving supply chain will be a key driver in cost reductions which is vital in ensuring that offshore wind is an economically viable option.

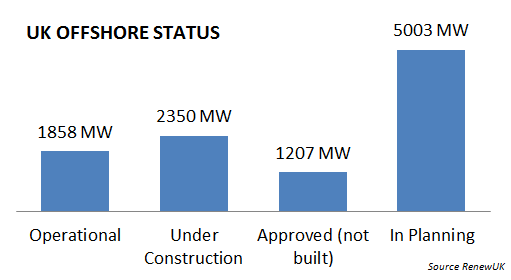

The marine renewable market is still in its infancy and will

need to develop exponentially in order to meet government and EU targets by 2020. The main focus in the UK has so far been to attract a turbine manufacturer to the UK but increasingly government policy is supporting the growth of a local supply chain and with the formation of the Offshore Wind Developers Forum (OWDF), consisting of Government and senior executives from 17 developers who agreed the following vision in February 2012:

The marine renewable market is still in its infancy and will

need to develop exponentially in order to meet government and EU targets by 2020. The main focus in the UK has so far been to attract a turbine manufacturer to the UK but increasingly government policy is supporting the growth of a local supply chain and with the formation of the Offshore Wind Developers Forum (OWDF), consisting of Government and senior executives from 17 developers who agreed the following vision in February 2012:

"The UK to be the centre of offshore wind technology and deployment, with a competitive supply chain in the UK, providing over 50 per cent of the content of offshore wind farm projects."

In the UK the industry currently employes 800 full time employees (RenewableUK, 2011) but by 2035 it could employ 19,500 individuals, drawing investment of £6.1 bn and generating GVA of £800 m per annum (Redpoint Energy ltd, 2009).

By 2050, the Renewable Ocean Energy sector could provide 470,00 jobs throughout Europe, which corresponds to 10 to 12 jobs (direct and indirect) created per megawatt installed (EU-OA, 2010).

Extracts from The Marine and Offshore Energy Report Feb.2012: